The Sales Tax section in Smackdab puts you firmly in the driver's seat for managing how sales tax is calculated and applied to all your invoices and quotes. Whether you need to handle percentage-based taxes (like VAT or GST) or fixed-amount charges, this powerful tool ensures every transaction is accurate and consistent.

Say goodbye to manual calculations! With customizable tax rules, you can easily meet local, regional, or even product-specific tax requirements. This is a huge time-saver, especially if your business operates in different locations or deals with various tax rates for different products or services.

Smackdab makes managing multiple tax setups a breeze, all in one convenient place. This means your team can work faster, stay compliant with regulations, and steer clear of costly errors. Whether you're setting up your taxes for the first time or adjusting to new rules, everything you need is right here in one centralized, easy-to-use section!

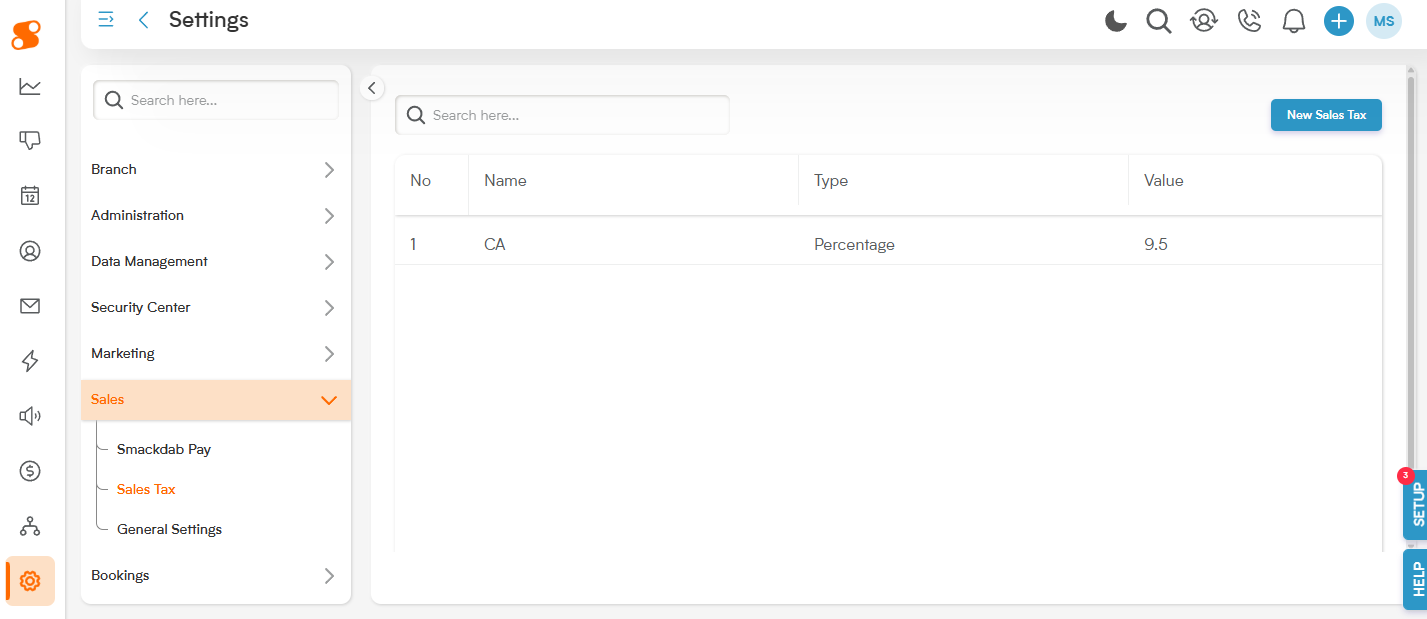

To edit your Sales Tax rates, you'll navigate to Settings>Sales>Sales Tax, and here you'll be able to add new Sales Tax rates to your list.

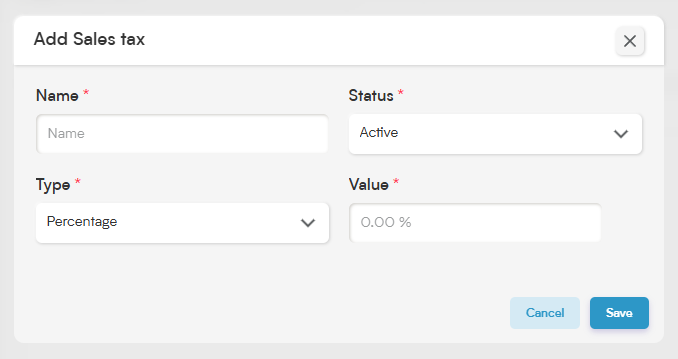

To add a new Sales Tax rate to your list, click on the blue "New Sales Tax" button to be taken to the Add Sales Tax window.

Name: The name you want to reference your sales tax rate as, such as "CA" for California, or "Santa Monica" for a specific city's sales tax rate.

Status: Active or Inactive - this allows you to set the tax rate as selectable or non-selectable when creating invoices, checkout forms, etc. Inactive is great for old rates because it keeps it in the system for old records!

Type: Whether you want to charge the sales tax rate as a percentage of the total or a fixed dollar amount.

Value: The value of the percentage or fixed amount - for example, 10% or $250.

Once you hit the "Save" button, you'll be all set for that tax rate to be part of your Smackdab!

From the Sales Tax list page, you can also utilize the search bar at the top of the page to search through your sales tax rates and find the one you're looking for.